The Chinese currency is the Yuan Renminbi, it is referred to as Yuan, CNY or RMB (Renminbi). It is the only currency that can be used to purchase local items. In general, the Chinese do not use checks. Most payments, including payrolls, are done through bank transfer. Therefore, you will need to open a bank account before you get paid. Fortunately, this will likely be one of the easiest things you do in China.

Choosing a Bank

In the main cities, the three major banks are ICBC, China Construction Bank and Bank of China. Generally, the first two are more numerous in terms of branches. Check with your employer in China which bank they prefer you to bank with (if they have any preference at all). This is because it is cheaper and faster for companies to pay their employees if they use the same bank. Often, people have accounts with multiple banks just in case.

Apart from these three, there are smaller, more specialized banks also. Both China Minsheng Bank and China Merchants Bank get good reviews. There are some foreign-owned banks in the larger cities also, such as HSBC (British), Standard Chartered (British), Citi (American), Hang Seng Bank (Hong Kong) and DBS (Singaporean).

Although International banks are more geared toward expats, they may require large initial deposits and are not so numerous in terms of branches. Agricultural Bank of China is one of the larger banks in China, but is more suited toward those working in more rural areas, due to the number of branches.

Opening an Account

Opening an Account

Opening a Bank Account is very straightforward in China. You will need your passport, a contact telephone number and a contact address. Branches in more central areas are more likely to have an English-speaking representative. You will also need to bring anywhere between RMB15 to 25. This will cover the cost of your bank card and your initial opening balance.

You will have numerous forms to sign, and you will get your card right there and then. You will be asked to choose a 6-digit PIN code. Note that your bank card will not have your name on it, just your card number.

After you finish account opening process, which takes about 15 minutes, your card is ready for use.

Internet banking

Note that when you have your bank account, and if you want Internet Banking, you will have to request this. When you open Internet banking, you will also activate your telephone banking, so you should have a mobile phone set up beforehand. You will have even more documents to sign, and you will need your passport. When they activate your Internet Banking, they will give you your account’s security devices, which vary depending on the Bank. It may be in the form of a USB drive or a code-generating device. You will need these devices whenever you make a transaction using online banking. They will also give you instructions for your first Internet banking login. This will likely be in Chinese, however, so consult a Chinese friend if you need any help.

China UnionPay

China UnionPay

China UnionPay is the main (and only) debit card in China. It is similar to the Maestro, MasterCard and Visa systems we get at home. In China, you can conduct the vast majority of your banking (including deposits, withdrawals, bill payments and transfers) by using your card in an ATM of the same bank. Although China UnionPay is the only accepted payment system in China (apart from high-end hotels and restaurants), it is of less use in other countries.

Note that it is not guaranteed that merchants outside of China accept China UnionPay as a form of payment. For this reason, you may want to look into the possibility of transferring your funds out of China to your account at home before you go home for the holidays. Bank of China does issue a Maestro debit card, but this is only available upon request at the larger branches and after opening a US Dollar account.

International Transfers

Many of you may be planning to save extra money while you are in China and bring back home with you. In this case, you will probably want to wire the money to your account in your home country. This will certainly be easier if someone at your bank speaks English. The wire process is really pretty simple and your bank will walk you through it, but first you will need to convert your YUAN into your home currency. The bank will do this if you can prove that you already paid taxes on your money, therefore you will want to save your pay stubs! Without your pay stubs the limit for a foreigner is $500USD/day, so don’t wait until the last day! The average fee for international transfers is $25. You can also do an international transfer using Internet Banking. You will need your security device to do this.

There is another method for transferring money abroad, and that’s through PayPal. They will charge a 3% fee. Make sure you have two separate PayPal.com (not PayPal.cn) accounts, one linked to your Chinese account and the other to your account at home. Make a PayPal withdrawal from your Chinese account, and then transfer this sum over to your second PayPal account. Then, transfer the sum from your second Paypal account to your bank account at home. Note that you will need to have Internet Banking enabled on your Chinese bank account to do this, and you must activate your account to handle online payments. Instructions for this for each bank, in Chinese (use Google translate), can be found on here.

Wechat Pay & Alipay

Wechat Pay & Alipay

These two apps are revolutionizing the way transactions and money transfers are made. First launched as a chatting platform, Wechat has now lots more to offer. First limited to Chinese citizens only, Wechat pay is now foreigner-friendly and setting up an account has become much easier. What you’ll need is a debit card linked to Chinese bank account and a phone number. Wechat has become one of the most popular mobile payment solutions and it will make your life so much easier and more convenient. Same goes with Alipay. Trust our word for it.

A few clicks now suffice to send/receive money from/to anybody with a Wechat/Alipay account; comes in handy to split restaurant bills, pay services, pay online, give money, etc. Paying your bills and topping off your phone were never simpler because you can do it from your Wechat wallet as well. No more trips to your phone carriers. Both apps also allow you to order a taxi, book flight/train tickets for your next holiday, and even pay for your bottle of water at the convenience store.

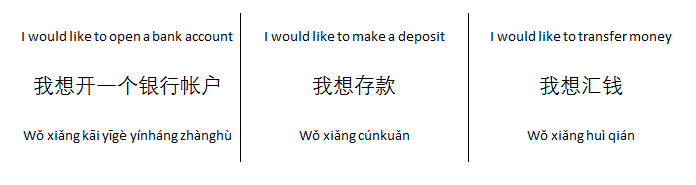

Useful phrases

This blog entry is curtsey of www.teachingnomad.com

Opening an Account

Opening an Account China UnionPay

China UnionPay Wechat Pay & Alipay

Wechat Pay & Alipay